About us

We’re a passionate team of property professionals, who support developers, brokers and investors to build together.

Since 2014, CrowdProperty has grown into one of the UK’s leading specialist lenders for property development projects

Since then we’ve been backing ambitious developers with around £1bn in funding and reshaping the way property finance works.

We’ve been FCA authorised since 2017, proving the strength of our platform, our rigorous due diligence, and our commitment to transparency, trust and client success.

Recognised as a leader in the space, we’ve played an active role in shaping the industry – from joining the P2PFA in 2018 to helping found the Innovate Finance 36H Group in 2020.

Today, we’re entering a bold new chapter – with fresh energy, deeper expertise, and a clear focus on delivering better outcomes for developers, brokers, investors and the homes we help bring to life.

![]()

Unlocking the potential of property developers to deliver much-needed homes

![]()

Connecting a community of developers and intermediaries with property expertise and funding to maximise their collective success

Our Values

Define the future

We define the future with highly skilled people overseeing increased numbers of homes created through improved processes, advanced technology and quicker access to reliable funding.

Lead by example

We lead by example with every area of the business striving to support our developers, intermediaries, investors and each other. Sharing our knowledge, experience and expert insights.

Succeed together

We succeed together ensuring sustainable and diverse financial investment. Developing shared success, better careers and higher returns in the housing market.

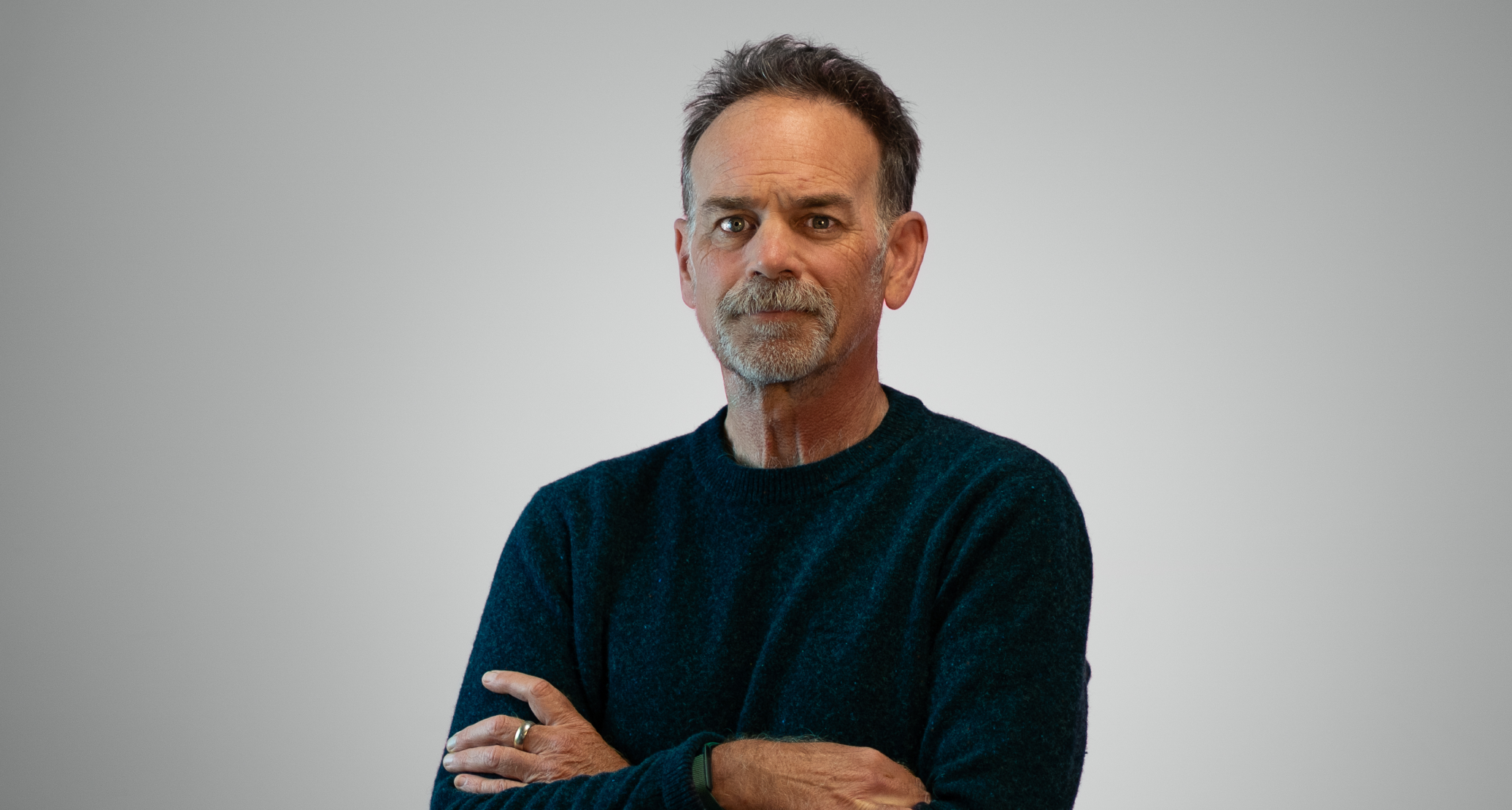

Meet the team

Steve Deutsch

Steve Deutsch

Chief Executive Officer

As CEO, Steve is responsible for CrowdProperty’s strategy, development and growth. An action-oriented leader, he has operated at Board level in financial services organisations since 2006, including CEO positions at GB Bank and Wesleyan Bank, with specialist experience spanning operations, commercial strategy and transformational change.

Steve Morgan

Steve Morgan

Chief Financial Officer

Steve is a Chartered Accountant and experienced CFO in banking and investment banking, with 25 years’ financial experience in retail and institutional lending environments.

John Mould

John Mould

Non-Executive Chairman

As non-executive Chair of the Board, John brings deep financial services, alternative finance and asset management operating expertise through high growth stages. As CEO of ESF Capital & ThinCats from 2015-2019, John oversaw the acquisition of ThinCats by ESF Capital and subsequently took the business from c.£150m cumulative lending to c.£600m. John’s previous executive experience includes positions at Hermes Investment Management, New Star Asset Management and Morgan Stanley.

Simon Zutshi

Simon Zutshi

Co-Founder

Simon has been a property investor and developer since 1995. He founded the ‘Property Investors Network’ in 2003 which holds 50 local property networking meetings across the UK each month in addition to educating thousands of property professionals. Simon is the author of Amazon bestseller ‘Property Magic’ and widely recognised as one of the top property experts, educators and mentors in the UK.

Emma Moriarty

Emma Moriarty

Chief Credit Officer

Tom Short

Tom Short

Head of Credit

Mark Davidson

Mark Davidson

Head of Loan Management

Dan Sullivan

Dan Sullivan

Head of Change & Technology

Andy Lacey

Andy Lacey

Head of Marketing & Communications

Lucy Hardman

Lucy Hardman

Head of Invstor Relations

Matt Bradley

Matt Bradley

Engineer

Ryan Cashmore

Ryan Cashmore

IT Systems Admin

Shannon Creen

Shannon Creen

Business Partnerships Manager

Geoff Diamond

Geoff Diamond

Investor Relations Officer

Raj Gogna

Raj Gogna

Senior Portfolio Manager

Asha Grant

Asha Grant

Broker Desk Manager

Rob anderson

Rob anderson

Head of Risk & Compliance

Mared Harrison

Mared Harrison

Investor Relations Manager

Sara Nasralla

Sara Nasralla

Head of Lending

Rupert Lowe

Rupert Lowe

Head of Business Development

Dan Mortimer

Dan Mortimer

Lending Manager

Serisha Mehmi

Serisha Mehmi

Finance Officer

Mike O’Raw

Mike O’Raw

Lead Designer

Laurie Price

Laurie Price

Credit Operations Manager

Luke Richardson

Luke Richardson

Senior Engineer

Katie Wild

Katie Wild

Business Development Manager

Who is CrowdProperty?

CrowdProperty is a fintech/proptech lending innovator, authorised and regulated by the FCA. We offer quick, easy finance for property professionals and property-secured income for investors.

How long have CrowdProperty been operating?

CrowdProperty have been operating since 2014, having grown into one of the UK’s leading specialist lenders for property projects – backing ambitious developers with around £1bn in funding and reshaping the way property finance works.

We’ve been FCA authorised since 2017, proving the strength of our platform, our rigorous due diligence, and our commitment to transparency, trust and client success.

How does CrowdProperty make money?

CrowdProperty is paid by the borrower for financing their projects – an initial fee and then interest on the amount they are loaned through the platform for each project, when it is completed.